What exactly could be the NVDL ETF?

Venturing into money marketplaces involves a profound comprehension of various instruments and practices, amongst which Trade Traded Resources (ETFs) stick out, delivering a particular approach to accessing precise sectors, industries, or asset classes. The NVDL ETF, A part of the Granite Shares ETF Belief, operates as an actively managed ETF aiming to duplicate 1.fifty instances the day by day share change of the fundamental inventory. In this discourse, we'll take a look at the NVDL ETF comprehensively, encompassing its overview, principal capabilities, expense system, and aspects pertinent to future investors.

NVDL ETF: An Overview

Operating being an actively managed fund, the NVDL ETF endeavors to achieve 1.50 moments the everyday effectiveness of its fundamental stock. This goal is realized through swap agreements with notable money establishments, enabling the fund to Trade returns or differentials in premiums of return earned over the fundamental inventory. Notably, this overall performance emulation is specific for just a singular working day, computed from the closure of regular investing on one investing working day to your closure on the next buying and selling working day.

NVDL ETF: Expense Approach

The financial commitment technique on the fund involves sustaining at the least 80% of its financial commitment publicity to economical devices demonstrating financial traits mirroring 1.5 occasions the performance on the underlying stock. This method predominantly depends on swap agreements, pivotal in enabling the fund to achieve its specific return. Additionally, the NVDL ETF possesses the flexibleness to take a position in several economical devices, which include U.S. Government securities, money marketplace resources, short-expression bond ETFs, and corporate personal debt securities rated as financial commitment quality. Diversification across these devices click here augments the fund's possibility management tactic.

NVDL ETF: Issues for Investors

Future investors should take into account various critical elements when assessing the NVDL ETF. Given its center on day-to-day rebalancing and also the compounding of returns, the fund's effectiveness above durations exceeding one working day might substantially deviate from one hundred fifty% with the underlying stock's return. This renders the fund's efficiency prone to the effects of compounding, significantly When the fundamental inventory's overall performance exhibits volatility over time. Furthermore, the expenditure exposure of your NVDL ETF is concentrated during the semiconductor marketplace, thereby rendering the fund's returns delicate to the overall overall performance of this sector. Investors inclined in direction of diversification throughout several industries should duly think about this focus possibility right before committing cash.

In Conclusion

In summation, the NVDL ETF offers an intriguing expense avenue for individuals trying to find publicity to a specific sector with Improved everyday functionality probable. However, its method involves intricacies which include day-to-day rebalancing, compounding results, and focus hazard inside the semiconductor business. As with every expenditure selection, conducting thorough investigation and comprehending the fund's technique and hazard profile are crucial.

Disclaimer: This article serves entirely for informational applications and doesn't constitute expense information. The creator does not supply any financial commitment advisory solutions. Buyers are recommended to conduct their own individual investigate and look for advice from economic industry experts prior to making any investment decisions.

Daniel Stern Then & Now!

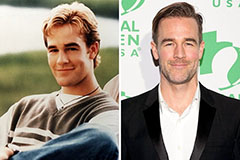

Daniel Stern Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Elin Nordegren Then & Now!

Elin Nordegren Then & Now! Catherine Bach Then & Now!

Catherine Bach Then & Now! Ricky Schroder Then & Now!

Ricky Schroder Then & Now!